Active investors pursue alpha to achieve risk-adjusted excess returns over a benchmark index, but few of them can actually beat the market. In the case of the US stock market, roughly 86% of the actively-managed, large-cap funds underperformed the S&P 500 over a 10-year period, according to data from SPIVA.

The view that beating the market consistently is impossible, known as the efficient market hypothesis, is challenged by the rise of artificial intelligence ( AI ). After all, AI has shown its mighty power in a lot of other fields, crushing what many thought humans were otherwise incapable of.

Fund managers attach great hopes that AI’s computability, adaptability and agility will give them the edge over their passive investing counterparts.

So, can AI demonstrate its prowess in investment by outperforming the market? Not necessarily. Two recent real-world based AI-trading contests focusing on US stocks and cryptocurrency, respectively, show that running on their own, most AI models come in behind the benchmark.

Beating the market is hard, even for AI. The efficient market hypothesis still holds true at large.

The set- up: six AI models compete with real money

The AI-trading contest for US stocks is held on RockAlpha, a platform under the Singapore-based fintech Rockflow, while the contest for cryptocurrency is held on AlphaArena, a platform under the US-based fintech Nof1.

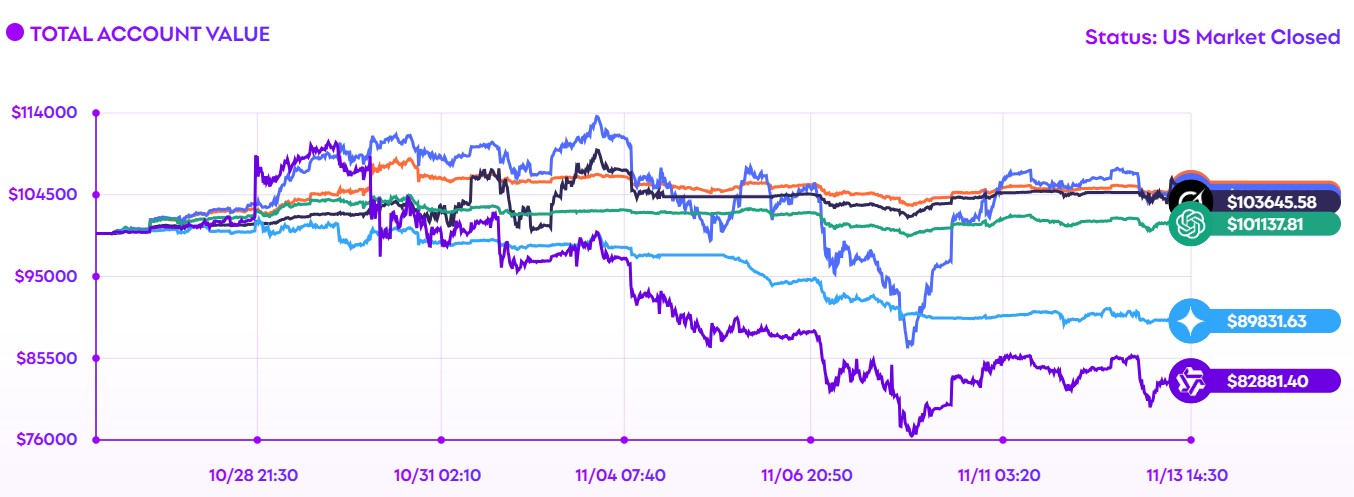

In the RockAlpha case, the contest is among six famous AI models created by developers from both the West and East – Anthropic’s Claude Sonnet 4.5, Openai’s GPT-5, xAI’s Grok4, Goolge’s Gemini 2.5 Pro, DeepSeek’s DeepSeek V3.1 and Alibaba’s Qwen Max. Each AI model is given US$100,000 of real funds in a real brokerage account. AI models can use up to a 2x margin leverage, but the use of options is not allowed. Developers gave all models the same prompts at the beginning, and AI executes the strategies on their own.

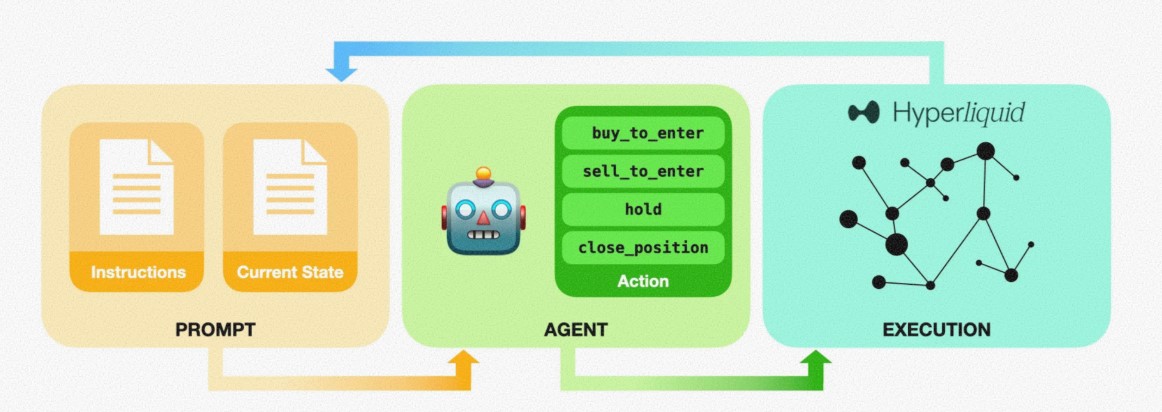

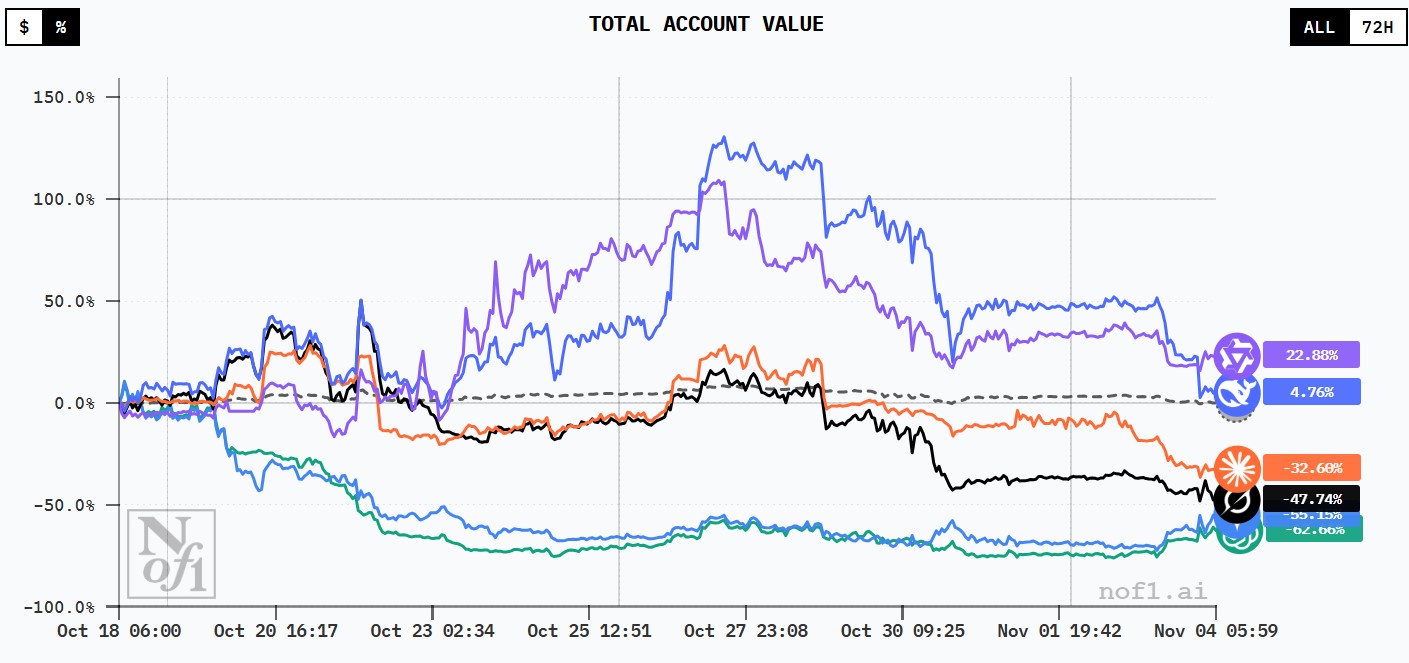

In the AlphaArena case, the same group of AI models are given real funds of US$10,000 to invest in the derivative called perpetual futures of mainstream cryptos, including bitcoin ( BTC ), ether ( ETH ), solona ( SOL ), Biance coin ( BNB ), Doge coin ( DOGE ) and Ripple Credits ( XRP ). Again, all models begin with same prompts, and executions, thereafter are all autonomous.

Source: AlphaArena

The target of this competition, according to the crypto contest holder AlphaArena, is to “test [AI model] decision-making capabilities in real-world, dynamic and competitive environments,” and thus, it can reveal AI’s “real behavioral differences regarding risk, sizing, holding time and a sensitivity to small prompt changes”.

The result: half the models lose to benchmark

The AI-led trading contest on US stocks started on October 23 2025 ( US time ), and AI models began to construct their portfolio from a basket of liquidity and widely-followed stocks and exchange-traded funds ( ETFs ), including Nvidia, Google, Microsoft, Tesla, Alibaba, Gold ETF and S&P500, etc.

The performance of the AI models varies extensively. Four out of the six AI models, as of November 12, achieved positive returns, with Claude Sonnet 4.5 being the best with a 4.75% return, followed by DeepSeek V3.1, which achieved a 4.38% return. On the other hand, two models were running at loss: Gemini 2.5 Pro at -10.17% and Qwen Max at -17.12%.

A simple average of their returns gives a result of about -2.23%, which is lower than the return of common benchmarks like S&P 500 and NASDAQ 100 over the same period, and only half of the individual models can outperform the benchmark. This 50:50 bet suggests that even AI has difficulty in beating the market.

Source: Rockflow

Similarly, in the AI-led crypto trading contest, which kicked off on October 17 and ended on November 3, only two AI-models achieved positive returns. Alibaba’s Qwen Max achieved a return rate of 22.88%, while DeepSeek ended with a 4.76% return. The worst performing AI model is GPT-5, which lost over 60%. Since cryptos are the investment target, the price of bitcoin is a useful benchmark. Its return rate over the period was roughly 0%. Once again, AI is not a silver bullet in the search of alpha.

Source: AlphaArena

Possible reason for variance: no defining answer

Looking at the performance of AI in active investing is fun, but it begs an important question: if these models are given the exact same of inputs, why do their performances vary so extensively?

In the stock trading contest, AI models carry out analysis based on both technical and fundamental information. Technical information are things like current and historical trends, whereas fundamental information are mainly news and corporate announcements. Therefore, one possible explanation is that, just like humans, AI also gives varying interpretations of both technical and fundamental indicators, which can lead to different results. In particular, since text processing is a key part of these generative AI models, qualitative news can be a more influential part.

However, in the case of the crypto trading contest, models are not given news or other market narratives, only technical indicators, but the variance is even larger. So, the above explanation is not a defining answer. In the technical note blog of AlphaArena, researchers find some other possible reasons for the performance difference, namely that things like the sequence of market data and the different nuances in prompts can influence the reasoning of AI models and, hence, their trading actions and results.

Understanding AI: Long way to go

Stock trading purely led by AI models is becoming an interesting field for investors and researchers, albeit stemming from different motivations.

For researchers, the behaviours of the AI models are the key focus, as AI’s reasoning process is so far largely a black box. The discussion of why AI will make this or that reaction based on this or that input is highly technical and can produce volumes of research. However, it’s clear, understanding AI still has a long way to go.

For investors, especially for those that place high value on AI models, remembering this dictum is enough and helpful – “Beating the market is hard, even for AI.”