Blockchain technology is making significant inroads into conventional finance. Despite challenges arising from legacy systems and legal uncertainties, financial institutions are actively experimenting with blockchain to unlock new efficiencies in collateral management.

Collateral management, the process of monitoring and managing assets pledged as security in financial transactions, remains constrained by fragmented systems, outdated tools, and the lack of real-time visibility. Incorporating blockchain could introduce significant opportunities for cost reduction, capital optimization, and operational efficiency.

A global bank handling around US$100 billion in daily repo transactions could potentially save between US$150 million and US$300 million per year by improving collateral optimization and accelerating settlement cycles, according to Ripple and Boston Consulting Group. These savings primarily stem from better capital utilization, faster trade execution, and lower operational overhead.

Operational risks

Financial collateral, such as cash or government securities, plays a crucial role in securing liquidity and mitigating counterparty credit risk in transactions like derivatives trading, repo operations, and securities lending. As of 2024, approximately US$27.8 trillion in assets were pledged as collateral globally, with repos accounting for about 82% of this total, according to Moody’s.

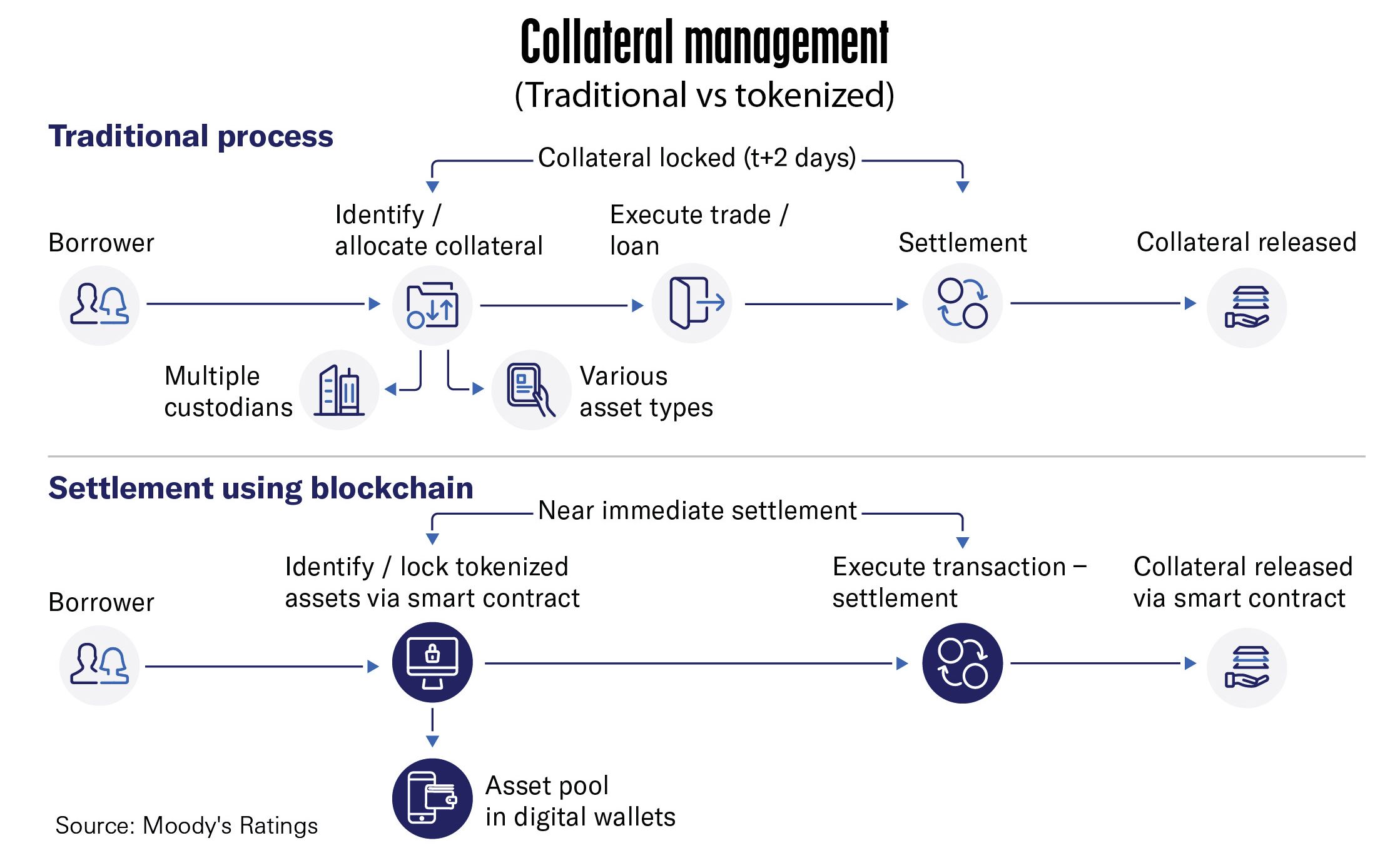

However, conventional collateral management processes are often slow and inefficient. Settlement delays ( commonly T+1 or longer ), fragmented custodianships, and time-zone differences create systemic friction, heightening operational and counterparty risks.

Blockchain-based systems allow the near real-time transfer of asset ownership on distributed ledgers – without physically moving the underlying assets. This reduces the need for large operational buffers and enables more agile use of capital.

Enhanced transparency

These efficiencies are increasingly recognized across global markets. For example, in August 2025, J.P. Morgan launched an intraday repo solution integrating its blockchain-based bank accounts ( Kinexys Digital Payments ) with the HQLAX collateral management platform. This innovation allows clients to use high-quality liquid assets ( HQLA ), such as government bonds, as collateral for real-time repo transactions across multiple distributed ledger technologies ( DLTs ).

Similarly, Hong Kong is investing in blockchain infrastructure for asset tokenization and collateralization. In October 2025, Hong Kong’s Legislative Council emphasized in an official statement that blockchain can “address many pain points in financial transactions and business operations”, underscoring the city’s commitment to digital infrastructure development.

Blockchain’s immutable and shared ledger offers a single, transparent source of truth for collateral transactions. Every ownership change and collateral movement is recorded on-chain, creating an easily auditable history. Real-time tracking of collateral positions gives authorized participants up-to-date insights into asset status, thereby enhancing oversight and trust across institutions.

Enhanced collateral mobility

Tokenization allows traditional assets, such as bonds or funds, to be represented as digital tokens on a blockchain. This transformation allows assets to be allocated, reallocated, and mobilized instantly and automatically based on real-time market conditions.

This capability significantly enhances capital efficiency, reducing the need for over-collateralization, where institutions hold surplus assets as a precaution. With tokenized collateral, financial firms can deploy assets precisely when needed, improving liquidity throughout the broader financial system.

In 2025, the Depository Trust & Clearing Corporation ( DTCC ) launched its Digital Securities Management ( DSM ) platform to modernize securities processing via tokenization. DSM enables instant, atomic settlement of digital assets and supports a wide range of financial instruments, including stablecoins, tokenized funds, and debt securities.

Despite its potential, blockchain-based collateral management faces notable challenges, according to Moody’s. The lack of harmonized global regulations for digital assets and DLTs creates uncertainty for institutions operating across jurisdictions.

Managing digital asset custody also adds complexity, as secure key storage and control mechanisms must replace traditional intermediaries. Furthermore, blockchain’s transparency raises data privacy concerns, prompting financial firms to adopt privacy-preserving technologies such as zero-knowledge proofs and secure multiparty computation.