Southeast Asia’s five main economies will expand by 4.2% this year, two-and-a-half times the projected pace of growth in advanced economies, the International Monetary Fund ( IMF ) forecasts.

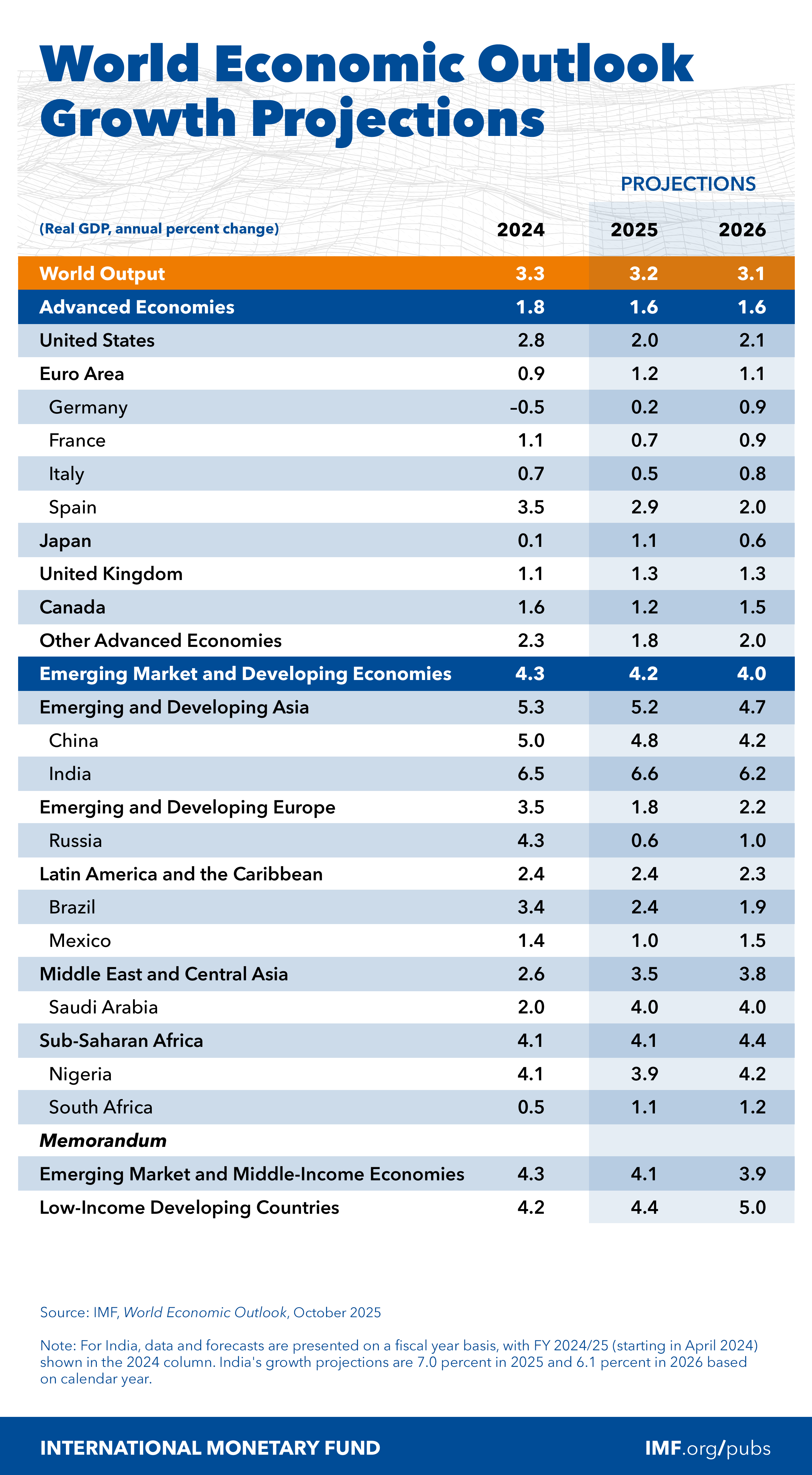

In its World Economic Outlook released this week, the IMF says advanced economies are expected to expand by only 1.6% in 2025, led by Spain ( 2.9% ) and the United States ( 2.0% ).

The latest projections for both the advanced economies and the “Asean 5” – Indonesia, Malaysia, the Philippines, Singapore, and Thailand – are 0.1 percentage point higher than the IMF’s updated forecasts in July.

Among all 10 members of the Association of Southeast Asian Nations, Vietnam is expected to record the fastest expansion this year, with growth forecast at 6.5% – in line with India ( 6.6% ).

The Philippines ranks second ( 5.4% ), followed by Indonesia ( 4.9% ), Cambodia ( 4.8% ), Malaysia ( 4.5% ), Laos ( 3.5% ), Singapore ( 2.2% ), Thailand ( 2.0% ), and Brunei ( 1.8% ). Myanmar’s economy is forecast to contract by 2.7%.

Among Asean’s partners in the Regional Comprehensive Economic Partnership ( RCEP ) – the world’s biggest free-trade agreement – China is projected to grow by 4.8% followed by Australia ( 1.8% ), Japan ( 1.1% ), South Korea ( 0.9% ), and New Zealand ( 0.8% ).

For emerging and developing economies in Asia, “the evolution of growth forecasts largely mimicked that of effective tariff rates”, the IMF says, referring to import duties imposed by the US this year.

As for China, “a stronger-than-expected outturn in the past few quarters, reflecting front-loading in international trade and relatively robust domestic consumption supported by fiscal expansion in 2025, more than offset the headwinds from higher uncertainty and tariffs”.

US-China trade decoupling

The IMF also notes that the decline in China’s exports to the US this year has been “partly offset” by higher exports to the euro area and Asean – in part supported by the depreciation of the renminbi against most currencies ( excluding the US dollar ).

Trade decoupling between the US and China “appears to be happening sooner” when compared with the 2018-19 tariff shock against China from the US.

“Early signals from the latest trade data point to potentially faster trade shifts this time,” the Fund says. “For example, Chinese exports to third-country markets – especially in Asia and Europe – increased more in February-April 2025 than in February-April 2018.

“At the same time, Canada and Mexico have accounted for a small share of China’s change in exports since February 2025 and have made a negative contribution to US export growth, in contrast to 2018-19.”

Back then, the IMF recalls, China’s falling exports to the US were largely absorbed by Canadian, Mexican, and Asian markets.

Trade flows, meanwhile, are being redirected to Asia in several important sectors targeted by US tariff increases – including autos and parts – and to Europe in steel and aluminium.

“In addition, there is some evidence that changes in third countries, imports from China in a given sector, including to Asia, are correlated with the change in their exports in the same sector to other regions, including the US and Europe,” the Fund says.

"This may suggest that trade diversion to other markets is larger than what is captured in gross trade data and could be consistent with either trade reallocation, trade rerouting, or a combination of the two.”

‘Rules of global economy in flux’

For the world economy as a whole, the IMF is projecting growth of 3.2% this year. “The rules of the global economy are in flux,” it warns. “Details of newly introduced policy measures are slowly coming into focus, and growth prospects are shifting along with them.

“After the US introduced higher tariffs starting in February, subsequent deals and resets have tempered some extremes. But uncertainty about the stability and trajectory of the global economy remains acute.”

In addition to foreign aid cuts and new immigration restrictions in some advanced economies, “several major economies have adopted a more stimulative fiscal stance, raising concerns about the sustainability of public finances and possible cross-border spillovers”, the Fund says.

“The world’s economies, institutions, and markets have been adjusting to a landscape marked by greater protectionism and fragmentation, with dim medium-term growth prospects and calling for a recalibration of macroeconomic policies.”