Two autonomous-driving companies already trading in New York have secured the final regulatory nod to sell shares in Hong Kong, joining a trend of Chinese stocks seeking secondary listings in the city.

With the strong momentum of “A+H” dual listings and the return of US-listed companies, Hong Kong is projected to finish 2025 as the world’s top venue for initial public offerings ( IPOs ).

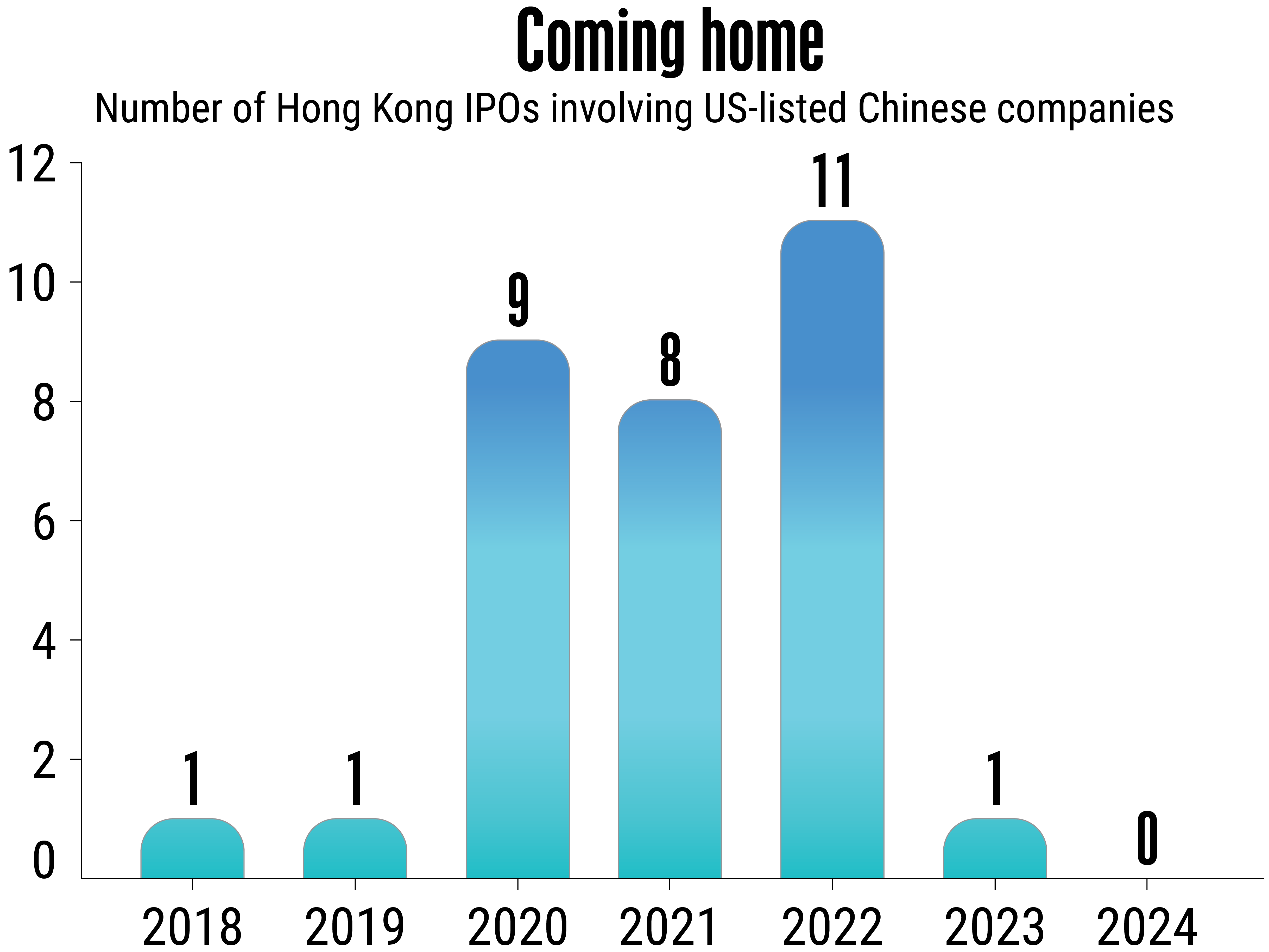

Hong Kong’s once-frozen “invisible gate” for US-listed Chinese companies is showing signs of thawing after the China Securities Regulatory Commission ( CSRC ) issued overseas listing filing notices for autonomous-driving firms Pony AI and WeRide.

Pony may issue up to 102,146,500 ordinary shares on the Hong Kong Stock Exchange ( HKEX ), while WeRide may sell up to 102,428,200 ordinary shares on the HKEX, according to CSRC.

Pony launched its IPO in the United States in November 2024 and WeRide in October 2024, making them “returnees” to the local market.

The CSRC approvals follow a series of regulatory reforms in the city intended to attract domestic technology listings and encourage US-listed Chinese firms to add a Hong Kong quotation.

On September 16, Chinese Lidar ( light detection and ranging ) company Hesai Technology began trading in Hong Kong, completing a dual primary listing alongside its existing Nasdaq shares. Pony and WeRide are now following the trend.

Other US-listed companies have also shown interest in listing on HKEX. Chinese brokerage Tiger International, for example, says it would consider such as a move when the timing is good. Whether the reason is geopolitical risk or to be closer to end users, coming back to Hong Kong appears inevitable for China-related companies, according to senior officials of Tiger International.

Goldman Sachs calculates that about 27 Chinese companies listed in the US, with a combined market capitalization of US$184 billion, meet the requirements for a Hong Kong IPO. The six largest by value are PDD, Full Truck Alliance, Futu, Legend Biotech, Vipshop, and Zeekr. Listing in Hong Kong could give these companies a good chance to be revalued.

KPMG says Hong Kong is experiencing an unprecedented wave of listing applications and could reclaim the top position among global IPO venues by the end of 2025.

Global IPO proceeds during the first three quarters of 2025 reached US$111.6 billion, 32% higher than the same period a year ago, with artificial intelligence and other emerging sectors drawing sustained investor attention, according to the accounting major.

Hong Kong hosted 67 new listings that raised HK$182.9 billion ( US$23.5 billion ) in the first nine months, up 49% in the number of deals and 229% in the amount raised compared with the corresponding 2024 figures.

Growth was led by A+H-share dual listings, which accounted for 11 deals and about half of the total IPO proceeds so far this year. The return of US-listed Chinese companies is expected to add further momentum to Hong Kong’s IPO market.