The US dollar is expected to continue its depreciating trend, prompting central banks and investors to diversify their reserves and assets into other currencies. The euro has emerged as the main beneficiary, while sentiment towards the renminbi is also rising.

Political and geopolitical risks are now top concerns for global reserve managers, according to the UBS Annual Reserve Manager Survey 2025, which gathered responses from nearly 40 central banks between May and June 2025.

The escalation of trade wars ranks as the most pressing risk, cited by 74% of respondents, followed by further escalation in geopolitical tensions. Economic volatility, including business cycles and inflation, was the third most cited concern, mentioned by 49% of respondents.

Despite these concerns, 79% of reserve managers believe the US dollar will retain its status as the global reserve currency in the coming years. However, 77% expect demand for the dollar to stagnate, keeping it broadly at current levels. Similarly, 76% believe that demand for US debt will remain at current levels while US yields will gradually rise.

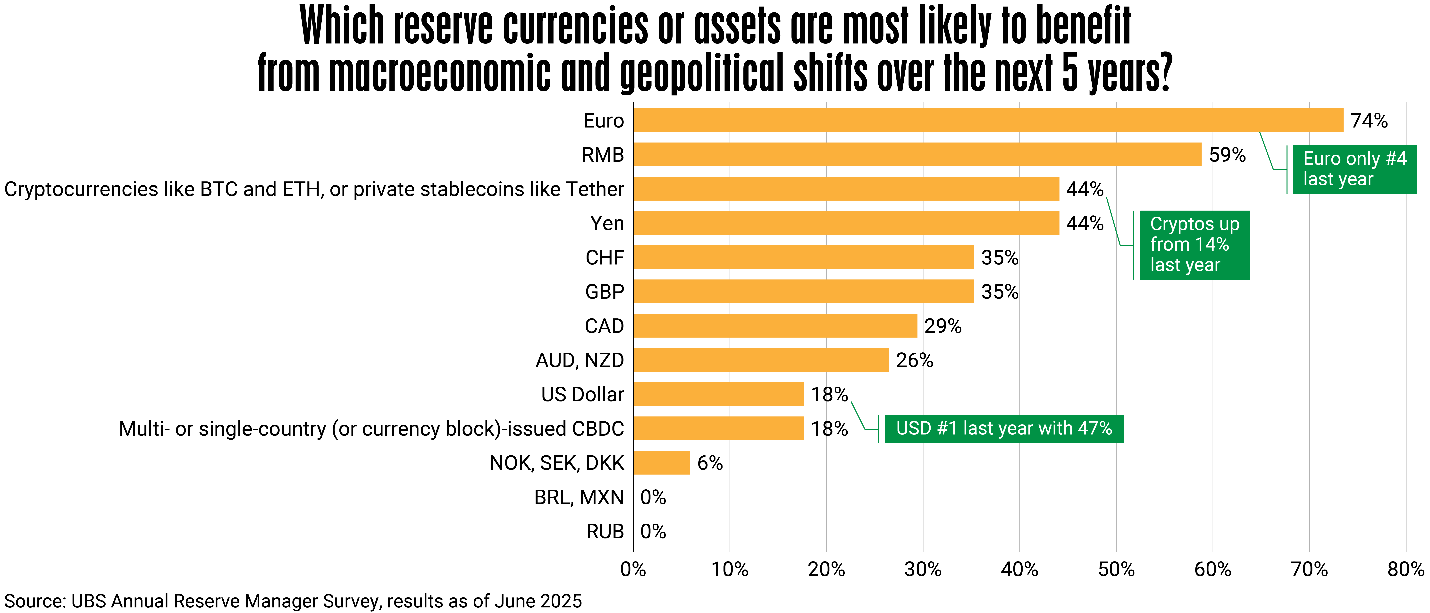

The US Dollar Index has declined by 9.82% year-to-date, while the Euro Currency Index has risen by 13.4%, according to MarketWatch. Survey results show that 74% of central banks believe the euro is most likely to benefit from macroeconomic and geopolitical shifts over the next five years, followed by 59% for the RMB. Surprisingly, cryptocurrencies ranks third, with 44% of reserve managers viewing them as potential beneficiaries.

Economic fundamentals are also playing a role in this shift. Eurozone GDP grew by 1.2% year-on-year in the first quarter of 2025, according to Eurostat, outperforming the US, where real GDP decreased at an annual rate of 0.5%, based on the latest estimates from the US Bureau of Economic Analysis. China, despite facing earlier downward pressures, posted a 5.4% year-on-year GDP growth in the first three months of the year.

Meanwhile, RMB internationalization continues to accelerate. The Cross-border Interbank Payment System ( CIPS ), designed for RMB cross-border clearing, saw significant growth in 2024. According to the People’s Bank of China, CIPS processed 8.2 million transactions totalling 175.49 trillion yuan, representing year-on-year increases of 24.25% and 42.60%, respectively.

“The rising adoption of RMB as a currency for trade settlement in Asia and beyond, marks a significant turning point in the development of cross-border payments and liquidity product offering, especially as supply chains become more deeply integrated across regions. As RMB Internationalization progresses, the CIPS is evolving into a key pillar supporting the efficient and secure settlement of RMB transactions globally,” says Yvonne Yiu, head of global payments solutions, Greater China, HSBC.

“While the RMB offers new avenues for supply-chain payments and settlement, which to some extent might help in mitigating FX costs and currency risks, the access to RMB liquidity outside of Asia remains uneven, posing a challenge that also fuels infrastructure development and policy innovation.”

With geopolitical tensions rising and the global economic landscape shifting, the diversification of currency reserves appears to be gaining momentum, signalling a slow but notable trend toward de-dollarization.