Despite slowing economic growth, Hong Kong has retained its ranking as the most expensive retail destination in Asia-Pacific, with the city’s prime rental rates being the highest in the region, a new report finds.

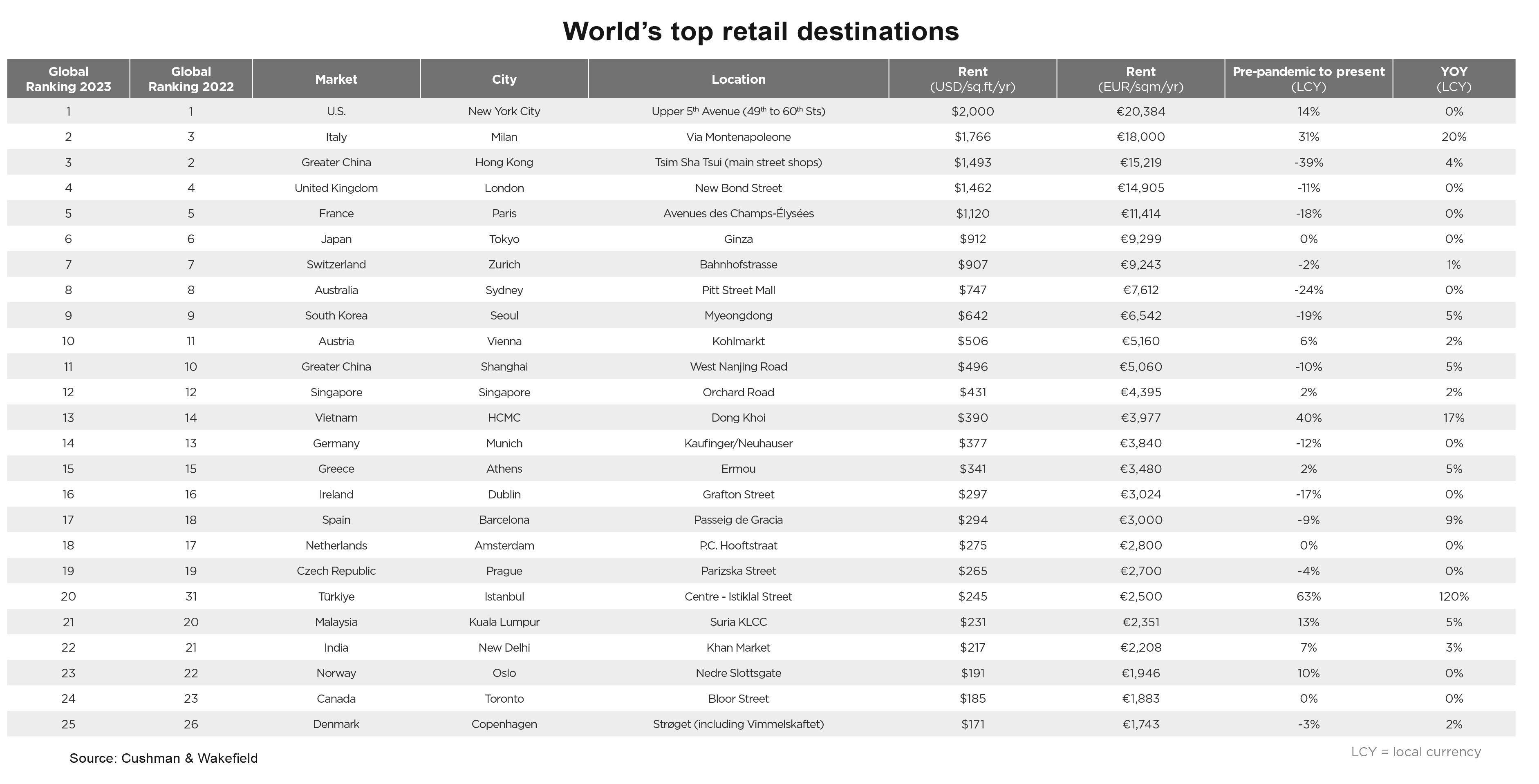

The city's Tsim Sha Tsui ( TST ) district remains at the top of the rankings in the region, while its Causeway Bay places second and Central is in eighth place. Globally, TST is the third-most expensive, after New York’s Fifth Avenue and Milan’s Via Montenapoleone, which moved up one place to take the second spot, according to the latest edition of Cushman & Wakefield’s Main Streets Across the World report, which examines prime retail rental rates in key cities globally.

Dominic Brown, report author and head of international research for Asia-Pacific at Cushman & Wakefield, says: “Retail has continued its path to recovery despite a new wave of post-pandemic challenges as central banks around the world have increased interest rates to tame the current inflationary cycle. In response, economic growth forecasts have been trimmed and consumers have reined in discretionary spending.”

Asia-Pacific recorded the strongest growth at 5.3%, followed by the Americas at 5.2% and Europe at 4.2%. Despite the comparatively strong growth, however, in most instances the increase in rents did not match peak inflation levels. Rental levels remained below pre-pandemic levels in 55% of the markets ( 70% of markets in Europe, 51% in APAC, and 31% in the Americas ).

Tourism growth

In APAC, Vietnam, Japan, and India all experienced substantial growth, with average growth rates ranging from 12% to 18%. Japan’s rental growth was driven by Midosuji in Osaka, which recorded an increase of 60% following a robust recovery in international tourism, while rents in Banjara Hills, Hyderabad, rose by 40% off a comparatively low starting point. Rents in Ho Chi Minh City and Hanoi were up 17% and 20% year-over-year, respectively.

While just over half of APAC markets have yet to fully recover rental declines experienced during the pandemic, there have been improvements over the past year. Hong Kong remains the market with the greatest potential for recovery, with rents still at 42% below where they were prior to the pandemic; Australia has also seen limited recovery.

“Although hampered by the global economic slowdown, Hong Kong’s high street retail recovery remains resilient, supported by growth potential from its previous low base during Covid,” says Kevin Lam, executive director and head of retail services, Hong Kong. “Thus far, we have observed notable changes in the retail landscape, with consumers increasingly opting for ‘retailtainment’, wellness and experiential offerings, which will help drive store upgrades and upward momentum in rents.”

Shifting focus

In a separate report, Unleashing Retail Innovation: Discovering the New Edges for Hong Kong, Cushman & Wakefield notes that the city’s retail industry is shifting from its traditional focus on luxury and pure consumption to experiential retail, backed by growing consumer demand for innovative concepts, events and retailtainment.

The health and wellness sectors are also important emerging retail market forces, as landlords, operators and retailers move quickly to introduce sports concepts into malls to boost footfall and enhance sales performance.

“Despite Hong Kong’s tourism and retail industries’ recovery following the border reopening, the government’s data indicate that 1H 2023 overnight and same-day visitor spending on shopping is at just 55% and 18% of the 1H 2018 level, respectively,” notes Rosanna Tang, executive director and head of research for Hong Kong.

“This demonstrates that the focus of visitors in Hong Kong has shifted from ‘shop till you drop’ to a greater desire for local culture and experience-based touring. The changing retail landscape, including the rise of e-commerce, the strengthened HK dollar performance against other currencies, as well as competition from neighbouring GBA cities, are posing challenges for Hong Kong retailers and mall landlords, spurring them to implement ‘out-of-the-box’ retail solutions to maintain competitiveness.”

While consumers are increasingly seeking experiential retail offerings such as entertainment, innovative pop-ups, wellness services and cultural concepts, Hong Kong remains a strategic location well-positioned to host international mega events and concerts. Cushman & Wakefield believes that Hong Kong retailers, landlords and the government should collaborate to devise new retail experiences in line with the city’s portrayal as “Asia’s World City”.