Climate-focused investors now have more choices than ever before with the number of open-ended and exchange-traded funds ( ETFs ) with climate-related mandates rising from fewer than 200 in 2018 to more than 1,400 as of June 2023, according to a recent report.

In the last 18 months, the assets in these funds have surged 30% to US$534 billion, boosted by inflows and product development, finds Morningstar's Investing in Times of Climate Change 2023 report, which examines the global climate-focused fund landscape and aims to help investors navigate it.

Other key takeaways from the report include:

- Fuelled by higher investor interest and regulation, Europe remains the largest and most diverse climate fund market, accounting for 84% of global assets. China and the United States rank second and third, with 8% and 6% market share, respectively.

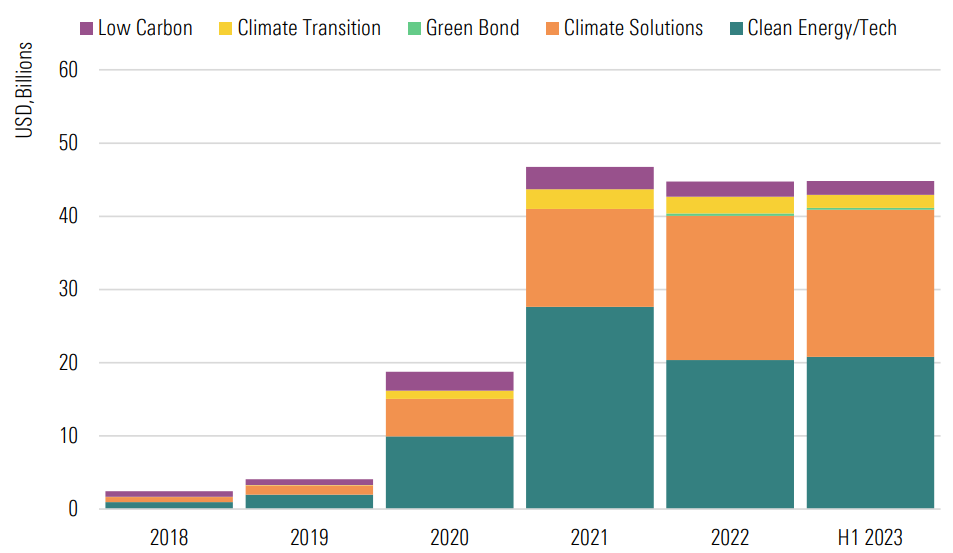

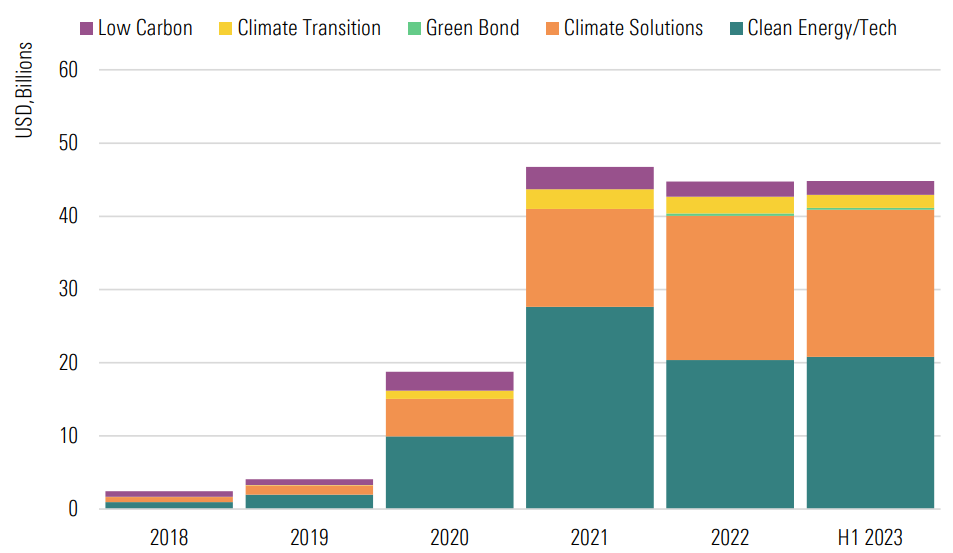

- Owing to the Covid-19 outbreaks and lockdown restrictions dampening China's economy, as well as a weakening currency, assets of Chinese-domiciled climate funds slipped from their historic high of US$47 billion in 2021 to just under US$45 billion at the end of December 2022, and assets have remained flat so far this year. Assets measured in renminbi witnessed 8% growth over the same period.

- None of the most common companies in climate funds are aligned to 1.5 degrees Celsius. The most popular stocks in broad market climate portfolios are more misaligned than those in portfolios that target climate solutions, with average implied temperature rises of 3.3 degrees Celsius versus 2.4 degrees Celsius. This can be explained by the high and difficult-to-manage carbon emissions coming from the supply chain or customers of top companies in broad market portfolios.

- Funds offering exposure to climate solutions exhibit high carbon intensity though. These funds tend to invest in transitioning companies that operate in high-emitting sectors, such as utilities, energy and industrials, and that are developing solutions to help reduce their own emissions and those of others.

- As of June 2023, assets of climate solution funds accounted for almost half of the total assets in Chinese climate funds. Low-carbon and climate transition strategies remained less popular in China, taking up less than 10% of total assets.

The chart below shows the assets in Chinese climate funds since 2018:

Source: Morningstar Direct. Morningstar Research. Data as of June 2023. Data includes Hong Kong SAR.

“The growth of climate-related funds over the past five years is simply remarkable and reflects the growing awareness of the investment risks and opportunities arising from climate change,” says Hortense Bioy, global director of sustainability research at Morningstar. “Our analysis of these funds reveals a gloomy reality, though. None are aligned with the goal of limiting global warming to 1.5 degrees Celsius.

“We’re not saying climate funds are greenwashing. The fact is that they’re investing in a tiny pool of companies and countries on track or close to being on track to achieve net-zero emissions by 2050.”